According to CNW Research’s July Retail Automotive Summary, at least a quarter million new-car intenders this year decided at the 11th hour not to buy. That’s a lot of revenue hanging in the balance – for the manufacturers and the dealers.

“They aren’t postponing the decision, (they are) simply electing to buy something else,” explained CNW president Art Spinella.

CNW found that 37.06 percent of these new-car intenders dropping out of the new-car market in the first half of 2013 chose to buy a non-automotive durable good instead – up from 34.12 percent for the full-year of 2012.

The following questions come to mind:

How does this affect used car sales?

How can the automotive industry, specifically the dealers, better convert intenders?

According to the report, the most common reason people are hitting the pause button is that their, “existing vehicle has at least a year of service remaining.” Other major reasons are that the monthly payment or sticker price is too high, job changes, and household needs changing.

s4We can speculate on several of the nuanced factors – mobile technology is sexier than new automobiles, even though auto tech is innovating right along with it. With the ultra-rapid release rate of new smart phones such as Sumsung’s popular GALAXY S4 this summer, gadget makers are more effectively controlling consumer pocket books.

Another major factor – The Millenials. – as described in the recent NPR program titled, “Why Millennials Are Ditching Cars And Redefining Ownership.” The article highlights a study on the the attitudes of millennials toward the car-buying process performed by Jill Hennessy, clinical professor at the Kellogg School of Management at Northwestern University.

The findings: Millenials are changing the transportation paradigm entirely.

“When we’ve talked to millennials, they actually answer that question quite thoughtfully,” Hennessy says. “While they do still want to own a car — not as much as they want to own a smartphone, by the way, that’s the physical possession they’re most attached to — they are thinking about, ‘Do I need a car or not?’ in a way that I think five years ago or 10 years ago we wouldn’t have seen to the same extent.”

Another noteworthy thing about millenials is that they argue, “we would rather spend money on experiences, not things.” As a Gen Xer, I would argue that they’re missing out on something profound here because with the American experience as a whole, as with numerous of my favorite lifetime memories, involve a car (further proving the marketing and communication divide on this issue!)

The economy’s slower-than-expected recovery and under/unemployment are also preventing more stable conversions of major ticket item sales, despite the continued record low interest rates.

As for used cars, 5.06 percent opted for pre-owned instead of a new car, off slightly from 5.44 percent in 2012.

What this means is, slightly fewer people are converting from new to used, and an increasing number of people are purchasing technology, appliances, and scooters over springing for that new car smell.

Manufacturers are obviously paying close attention to this. But what can dealers do?

Dealers must take advantage of every opportunity to convert leads while staying cognizant of the evolving spending priorities of consumers.

Stay top-of-mind by expanding automated long-term prospect and previous/service customer CRM touches (via multiple communication mediums) in anticipation of the elastic effect of the consumer behavior – keeping prospects in the lead funnel.

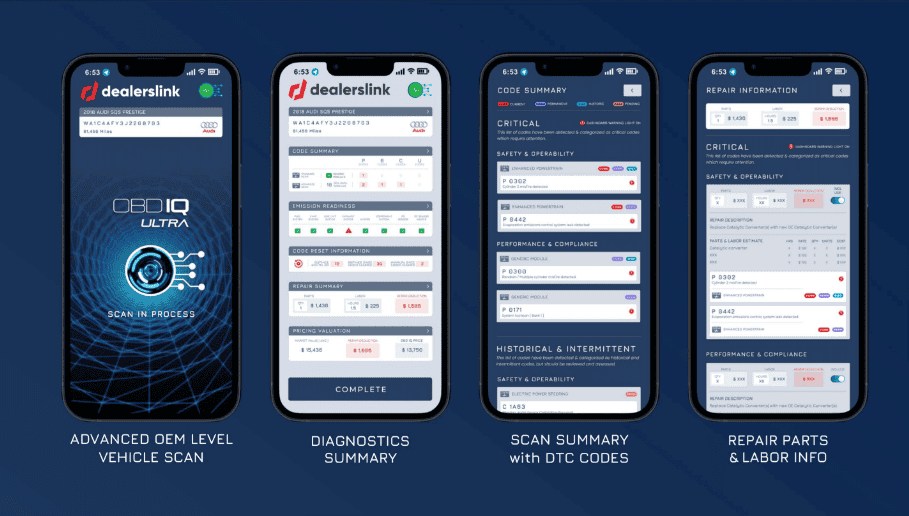

More effectively convert new to used car buyers with expanded inventory options – using innovative virtual inventory sourcing solutions by vendors such as Dealerslink.

Dealers have been doing it for a while now, but this data would suggest that incentives like offering an iPhone or a tablet may be highly effective. Dealers should stay on top of tech demand, and bundle those items into current new and used car sales programs.

Automotive retail today is a game of ever-changing statistical factors, and dealers should work on every front to stack the odds in their favor. The data tells us that billions of dollars is out there in swing-revenue, and auto manufacturers and dealers must be aggressively engaged in the challenge of converting those consumers.

To learn more about Dealerslink®

CONTACT: Travis Wise at 877-859-7080 x302 travis.wise@Dealerslink.com