(This article is the first of a three-part series)

With a membership that spans across the United States, we regularly interact with dealerships – both big and small, independent and franchise – to better understand their pain points and how Dealerslink might be able to help them. Our next series of blog posts will focus on independent dealerships and how our independent members are outperforming their peers.

As we’ve referenced in other articles, margin compression throughout the auto industry is taking a toll, with margins at all-time lows. This is especially true for smaller independent dealerships, who sell an average of one vehicle a day and make less on each one. There seems to be less room for error than ever before.

However, a look at our independent Dealerslink members shows

that a majority of them report their business has improved in the past two

quarters over the same period in 2017. So, what are they doing right? One part of that answer is that they are sourcing inventory smarter. Here are four ways they are doing that.

1. Making data-focused decisions

Top-performing independent dealers make sourcing decisions

based on data and individual assessments on each unit, not on their “gut” or on the lowest-priced vehicle they can find. They mine the data to look at specific factors and answer the following questions:

- Vehicle financials – Does the cost to market leave enough room to make gross?

- Vehicle velocity – Will a unit be a fast mover or is it going to sit around and age on your lot?

- Investment value – If you have to give a little on gross to acquire a unit, will it still make sense to invest in it?

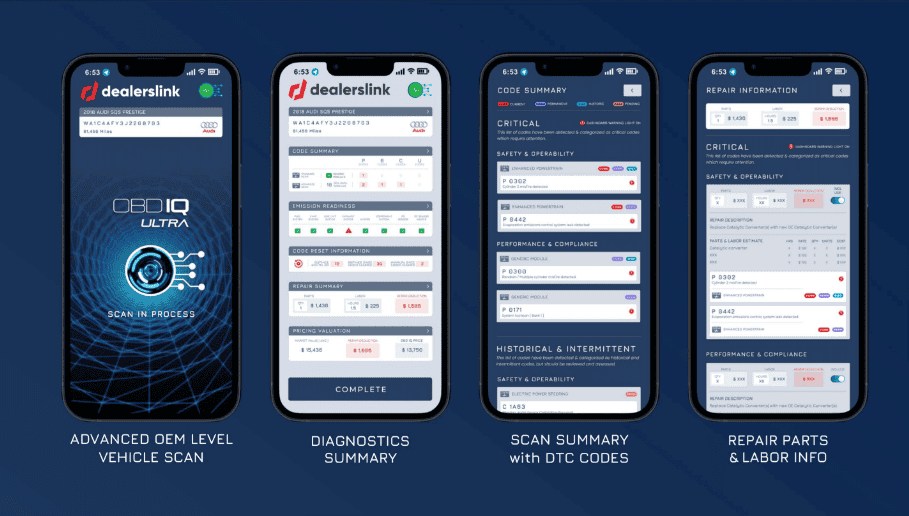

Dealerslink independent members get instant answers to these

questions through their appraising and inventory-management

tools, which help them make better auction/trade-in purchase decisions.

2. Expanding inventory reach

NIADA’s 2017 Used Car Industry Report indicates that independent dealers attend about eight auctions a month on average. They also source more inventory from physical auctions (55 percent) vs. online auctions (45 percent). Something of interest to note is that for top-performing independent dealers, the ratio is reversed (45 percent physical vs. 55 percent online).

The Dealerslink Marketplace allows top independents to find clean, retail-ready inventory directly from other dealers – that’s additional inventory they wouldn’t find at local auctions.

3. Spending less money on inventory

Every independent dealer knows that where you really make the money is on the buy, not the sell. Independents buy 15 vehicles a month on average, spending $5,250 in auction fees. As a reminder, Dealerslink never charges per-unit fees.

Our top independent Dealerslink members buy up to 40 vehicles a month, saving up to $14,000 per month in auction fees.

To find out how much your dealership can save in auction fees, try our online Auction Fee Calculator.

4. Spending less time sourcing inventory

The majority of independent dealers spend an average of about 23 hours a week researching vehicles and prepping for auctions. However, with automated want ads and inventory searches, our independent members spend about 30 percent less time on this task. That frees them up to focus more attention and time on in-store responsibilities like working deals and

appraising potential trade-ins.

Our members spend less time to acquire more vehicles, thanks to the efficiencies of sourcing inventory. The improvement in sourcing efficiency is part of the reason our top-performing independent members source more vehicles from a dealer-direct marketplace.

In part two of this series, we’ll explore how Dealerslink independent

members merchandise quicker than their non-member counterparts.

If you have any questions about Marketplace or any other

Dealerslink offering, call us at 844-340-2522 or email info@Dealerslink.com.