For dealerships, rising interest rates pose a growing challenge, directly impacting the feasibility of their floor plan expenses. This financial crunch requires swift action and creative solutions to maintain profitability.

Dealership Floor Plan and Interest Rate Hikes

A car dealership’s core asset is its inventory. Managed through a floor plan, this system is essentially a credit line allowing dealerships to buy vehicles from manufacturers. As vehicles sell, the credit is repaid, ideally generating profit. However, rising interest rates complicate this process.

Controlled by central banks, interest rates impact businesses, including dealerships. As rates increase, borrowing costs rise. This escalation impacts floor plan expenses – interest paid on inventory financing. With tight margins, these added costs erode profits and strain dealership finances.

Profit Squeeze Amid Tight Margins

Dealerships often operate on slim margins amidst competitive markets. Elevated interest rates amplify profitability struggles. This heightens pressure on already thin margins, as higher floor plan expenses erode profit from each sale. This might prompt price increases, potentially deterring price-sensitive customers.

Inventory Management and Cash Flow Impact

Rising interest rates on floor plan expenses have unintended consequences on inventory management and cash flow. As financing costs rise, dealerships might delay selling vehicles, leading to an overstocked lot and cash flow constraints. Funds that could be used elsewhere are tied up in unsold inventory.

Navigating the Challenge

Dealerships must proactively address these rising interest rates and escalating floor plan expenses:

- Diversified Revenue Streams: Beyond vehicle sales, exploring opportunities like maintenance services and accessories can generate additional income.

- Strong Financial Management: Close monitoring of financial statements, cutting needless expenses, and bolstering operational efficiency are crucial.

- Optimized Inventory: Maintaining lean, demand-aligned inventory prevents oversupply and cash flow issues.

- Negotiations with Lenders and Manufacturers: Engaging in discussions can provide relief from rising interest costs.

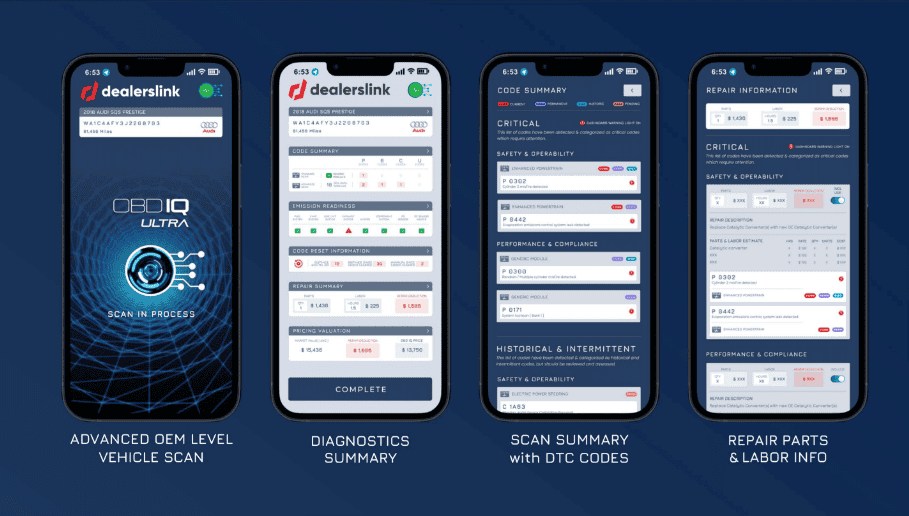

- Digital Transformation: Leveraging digital tools streamlines operations, optimizes marketing, and expands the customer base.

With interest rates rising to levels that we have not seen in over 20 years. Dealership managers need to be keenly aware of the effect of additional inventory carrying costs. With manufactures finally filling up backed ordered inventory, dealership inventory levels are starting to rise. For every $1 million in floored dealer inventory the dealership is now paying $8,000, or more, per month in additional interest payments versus just a year ago. If a store was stocking $1 million in new inventory in August 2022, and they have now increased to $10 million in inventory, the total monthly cost to the dealership is $80,000 more per month! Most dealers are excited to get back to the days of lots full of inventory, but the carrying costs of holding a lot of inventory should be balanced with the dealership need to maintain profitability.

Matt childers – Dealerslink performance manager

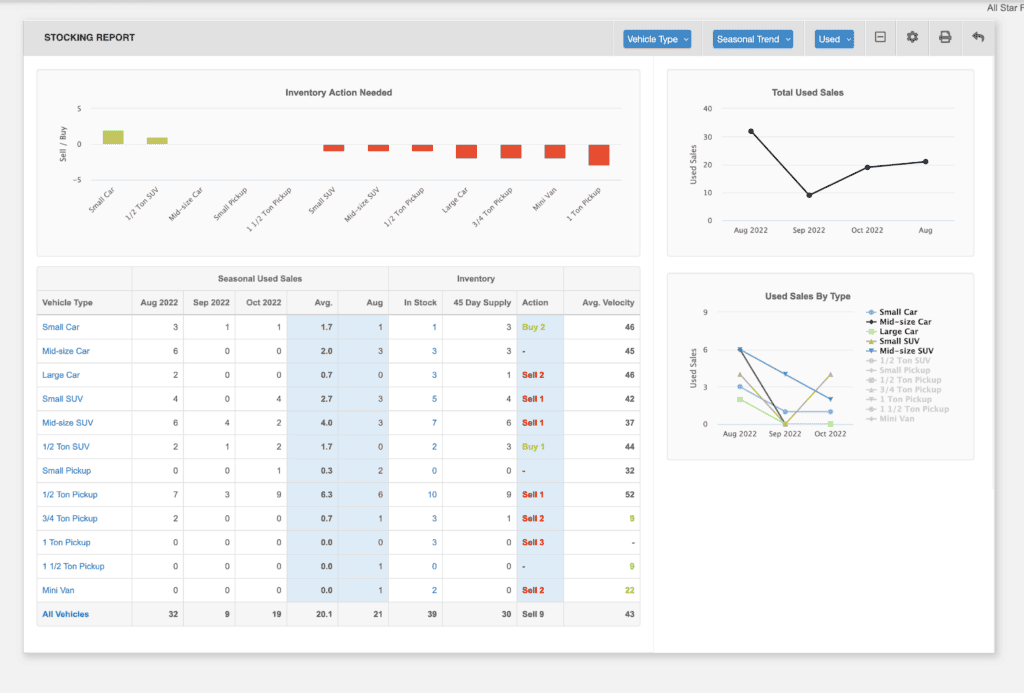

Using the Dealerslink Stocking Reports, the dealership is able to watch rising inventory dollar levels for both new and used vehicles and be able to keep a better eye on the situation.

Dealerships face a challenging landscape due to rising interest rates and their impact on floor plan expenses. Maintaining the equilibrium between inventory, cash flow, and profitability is complicated by external economic factors. Proactive action through revenue diversification, operational optimization, and strategic partnerships is key to weathering this challenge and emerging stronger in a dynamic market.