Recently, the automotive industry has been facing a formidable challenge as the number of rejected credit applications for auto loans reaches its highest level in five years. A Federal Reserve study reveals that the rejection rate for loan applications, including auto loans, has soared to alarming levels, causing concerns for prospective car buyers and dealerships alike.

The Rising Tide of Rejections

According to the Federal Reserve study, the rejection rate for automotive loans has reached a new high, rising from 9.1 percent in February 2023 to a staggering 14.2 percent in recent months, encompassing June. This surge is not isolated to auto loans alone; it cuts across all age groups and is most pronounced among individuals with credit scores below 680. In addition, the rejection rate for all credit applications has been at 21.8 percent over the past 12 months, further highlighting the severity of the issue.

Factors Behind the Surge

Various factors have contributed to the steep increase in credit application rejections, especially for auto loans:

- Rising Interest Rates: With interest rates on the rise, borrowing costs have escalated, making it more challenging for borrowers to meet stringent loan requirements. As a result, lenders have become more cautious about approving loans, particularly for applicants with lower credit scores.

- Lender Caution: Faced with concerns about potential delinquencies, lenders have tightened their lending standards, making it harder for individuals with subpar credit scores to secure auto loans. This increased caution among lenders has made it challenging for car dealerships to place subprime auto loans.

- Borrower Expectations: Interestingly, a significant number of hopeful borrowers now anticipate their loan applications to be rejected. The Federal Reserve survey reveals that almost one-third of applicants expected to be turned down for an auto loan, suggesting a growing apprehension among potential car buyers.

Impact on Car Dealerships

The surge in auto loan rejections has a direct impact on car dealerships. As credit applications decline to the lowest level since October 2020, dealers are facing reduced foot traffic and a shrinking pool of potential buyers. Subprime auto loans, in particular, have become harder to secure, limiting the market for dealerships and reducing their ability to cater to a broader customer base.

Navigating the Storm

While the prevailing situation poses challenges, car dealerships can take proactive steps to navigate through this storm:

- Diversify Financing Options: Dealers should collaborate with a variety of lenders, including captive OEM sources, traditional banks, credit unions, and online lenders, to offer customers a range of financing options. Diversifying financing sources can increase the chances of securing loans for potential buyers, even those with lower credit scores.

- Offer Incentives and Specials: To attract hesitant buyers and boost sales, dealerships can offer attractive incentives, such as cashback offers, low down payment options, or buying down interest rates. Dealers should also look to take advantage of escalating payment schedules offered by select lenders that allow the payment to gradual increase over time. Having all available tools for the finance department will help entice cautious buyers and encourage them to make a purchase.

- Marketing Plan: Review previously sold customers and breakdown into two marketing opportunities. First, individuals with a high APR financing and good payment history. Finance should work to see if they can get them into a new vehicle with a lower rate or refinance. Secondly individuals with low APR financing offer them low OEM APR options when available.

- Focus on Customer Education: Educating potential buyers about credit scores, interest rates, and the loan application process can empower them to make more informed decisions. By providing guidance and support, dealerships can build trust and credibility with their customers.

- Strengthen Customer Relationships: Building long-term relationships with customers can lead to repeat business and referrals. Dealerships should prioritize customer satisfaction, addressing concerns, and offering exceptional service to foster loyalty among their clientele.

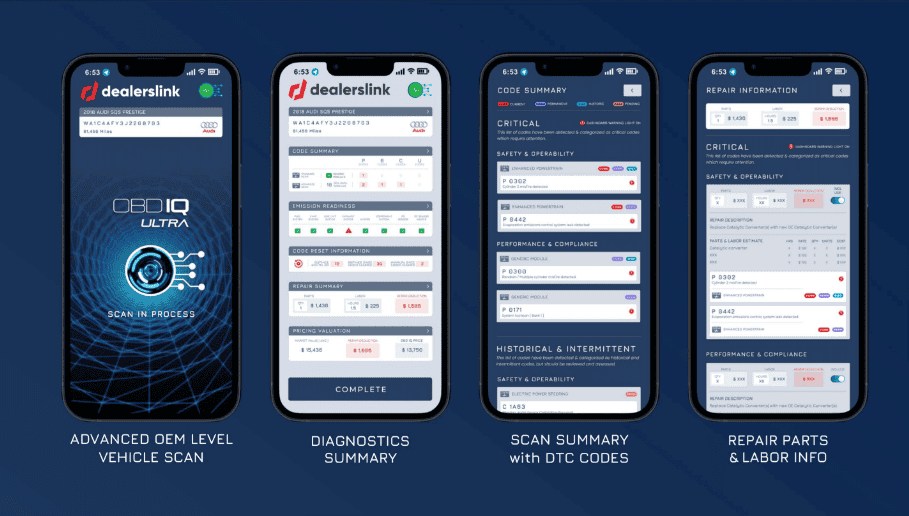

- Embrace Technology: Utilizing digital tools and online platforms can enhance the car buying experience for customers. From virtual showrooms to online loan application processes, embracing technology can streamline operations and attract tech-savvy buyers.

As the rejection rate for credit applications, especially auto loans, reaches its peak, car dealerships find themselves navigating challenging waters. Understanding the factors behind this surge and adapting to the changing landscape is essential for dealers to survive and thrive in the current market. By diversifying financing options, offering incentives, and prioritizing customer relationships, car dealerships can weather the storm and continue to provide their customers with top-notch service and unforgettable car-buying experiences.