Pricing strategies can make or break a dealership’s profitability. Today, relying on guesswork or outdated methods can lead to missed sales, shrinking margins, and sluggish inventory turnover. Dealers need to price vehicles strategically using real-time data and advanced analytics.

Here are three pricing mistakes that dealerships often make—along with the tools you need to avoid them and boost profitability.

Mistake #1: Pricing Without Market Data

The Problem:

Some dealerships still set vehicle prices based on their gut or outdated methods, ignoring the fact that today’s car buyers have more pricing transparency than ever. If your prices aren’t competitive or aligned with market demand, you’ll either lose sales or get stuck with overpriced inventory that won’t move.

The Fix:

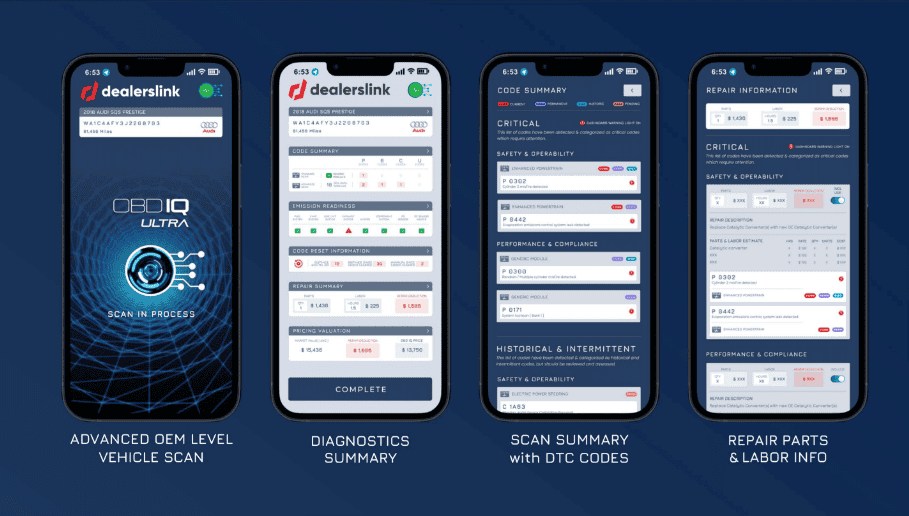

Data-driven pricing is key to staying competitive. The Market Pricing Tools from Dealerslink provide real-time pricing insights, allowing dealers to analyze local and national trends to set optimal prices. But pricing isn’t just about today’s market—it’s also about knowing what to stock next. Stocking AI takes it a step further, using machine learning to analyze the bestselling vehicle class and identifies which makes and models will yield the highest returns. This ensures your lot is filled with fast-moving, high-margin inventory from the start.

With Dealerslink, dealerships can pinpoint when a vehicle has the potential to be highly profitable based on actual sold store data—not just broad market trends. This allows dealers to strategically price units that may perform exceptionally well at their specific store, even if they don’t appear as strong in the overall market. By recognizing these high-margin opportunities, dealers can lock in profits at a higher asking price, maximizing front-end gross while ensuring they stock units that are most likely to sell at a premium.

Mistake #2: Holding Onto Aged Inventory for Too Long

The Problem:

Many dealers hesitate to discount or wholesale aged inventory, hoping for the “right buyer” to come along. Unfortunately, the longer a vehicle sits, the more it depreciates—tying up valuable capital and hurting overall turn rates.

The Fix:

A proactive inventory management approach prevents stagnant inventory from draining profits. Dealerslink offers tools for retail performance management to help track aging vehicles and reconditioning time making it easy to determine when to adjust pricing for a faster sale. Additionally, Velocity Reports provide a snapshot of true-market data, analyzing turn rates and market saturation to help you identify and source high-demand vehicles—ensuring your inventory is always working in your favor.

Mistake #3: Overlooking Profit Opportunities on the Backend

The Problem:

Too often, dealerships focus solely on front-end gross profits without considering backend revenue opportunities like F&I, warranties, and service contracts. This approach can leave significant profits on the table.

The Fix:

A balanced pricing strategy accounts for both front-end and back-end profitability. DMS Profit Analytics integrates historical sales data with F&I profit information, providing insights into past performance, ROI, and trends. By leveraging this data, dealers can make informed decisions that maximize revenue on every unit. For multi-location dealerships, Group Velocity Analytics takes it even further, analyzing inventory performance across locations to help allocate units where they will sell fastest and generate the most profit.

Turn Pricing Challenges into Profitable Decisions

Avoiding these common pricing mistakes isn’t just about selling more vehicles—it’s about making every sale count. With the Dealerslink suite of tools, you can set competitive prices, optimize inventory selection, and boost both front-end and back-end profits.

Want to see how Dealerslink can help your dealership refine its pricing strategy? Schedule a demo today and start making data-driven decisions that fuel real growth.