Trade policies don’t happen in a vacuum—they land squarely on the shoulders of the dealership’s general manager. In 2025, shifting tariffs are driving cost increases and unpredictability in vehicle pricing, forcing GMs to rethink everything from acquisition strategy to what they are telling their customers.

Why Tariffs Matter on the Lot

Tariffs are essentially taxes on imported goods entering the country, paid by the importer when the goods clear customs. When applied to vehicles or components, those costs ripple straight down the supply chain, often raising sticker prices for both new and used cars.

In 2025, we’re seeing tariffs impact all types for vehicles sales:

-

- According to Yahoo Finance & Bloomberg, tariffs on imported vehicles from China, the EU, and select Asian markets, are raising new car costs by an estimated 8–15% depending on the brand.

-

- Higher costs on parts, electronics, and EV batteries, which are estimated by BloombergNEF and Autovista24 to now account for nearly 40% of an EV’s total production cost.

-

- And there continues to be uncertainty around what the ongoing impact will be as potential “retaliatory” tariffs are still being discussed, followed by ReedSmith, particularly between the U.S. and China, that could target entire auto brands.

For a dealership GM, these pressures don’t just affect prices—they impact inventory cycles, acquisitions, and cash flow.

The GM’s Balancing Act

When tariffs shift, GMs must recalibrate in near real-time:

-

- Used inventory sourcing: As more buyers move away from new, trade-ins and wholesale sourcing continue to grow.

-

- Acquisition strategy: Some dealers are front-loading inventory purchases to hedge against the next tariff hike, while others delay and risk missing allocation.

-

- Pricing strategy: With affordability already stretched, according to Autobody News, average monthly payments on new vehicles crossed $780 in mid-2025—dealers must walk a tightrope to protect margins.

-

- Expense management: Payroll, marketing, and floorplan financing costs must be monitored more carefully during volatile cycles.

It’s a game of speed and balance: too slow and you miss pricing power, too aggressive and you’re stuck with overpriced units while consumers hold back.

Consumer Behavior Shifts

Buyers are adapting—but not uniformly. According to a recent survey, 2025 CarEdge Consumer Survey, results show a split in consumer response:

-

- Rush buyers: About 30% of consumers accelerate purchases ahead of predicted price hikes.

-

- Deferral buyers: Roughly 45% delay buying in hopes tariffs ease or incentives return.

-

- Shift-to-used buyers: Nearly 25% are now exclusively shopping used or certified pre-owned, feeding strength in that segment.

This unpredictability makes local market insight critical. Dealers who track pricing trends daily—not monthly—and call out both time-on-lot and market data through two-tier pricing are the ones best positioned to pivot quickly.

Where Data Tools Change the Game

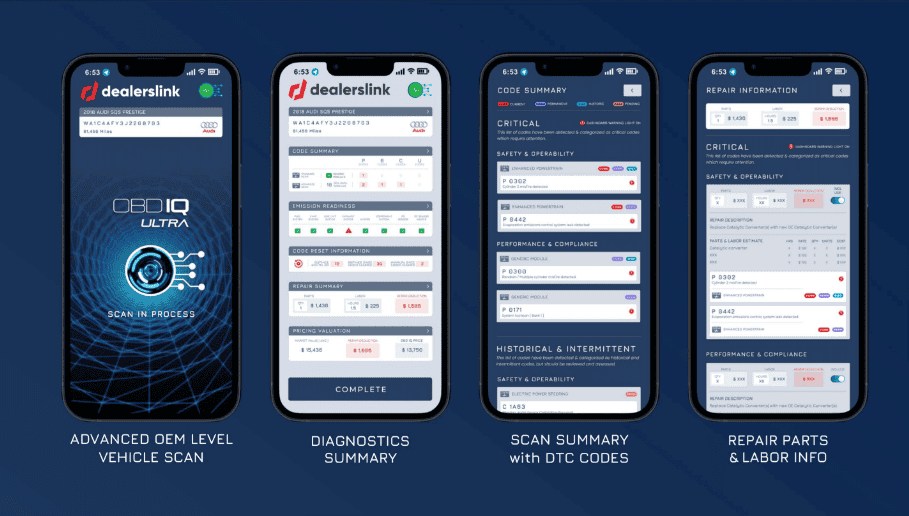

Digital inventory management platforms such as Dealerslink are providing crucial buffer strategies in 2025. Live data on wholesale costs, regional demand, and competitor pricing give GMs a stronger hand, especially in negotiations. In a market where wholesale prices continue to fluctuate, real-time visibility isn’t just helpful, it’s essential.

Turning Tariff Pressure into Opportunity

While tariffs add uncertainty to every stage of dealership operations, they don’t have to dictate the outcome. Dealerslink gives GMs the tools to stay one step ahead:

-

- Inventory Optimization: Tools like Stocking AI and ReconCloud streamline decisions on what to buy, how to price, and how quickly to turn.

-

- Live Market Data: Daily wholesale and retail insights keep pricing strategies aligned with real-time shifts.

-

- Smart Acquisition: Access to a nationwide dealer-to-dealer marketplace helps diversify sourcing and reduce reliance on tariff-heavy imports.

-

- Wholesale Exit Options: Built-in wholesale channels provide backup strategies when inventory gets squeezed by tariff-driven demand swings.

While tariffs are unlikely to stabilize soon, volatility brings openings. GMs who operate with agility—pivoting faster than the market shifts—can not only protect margins but also strengthen competitive positioning in 2025 and beyond. And with Dealerslink powering smarter acquisition, pricing, and wholesale strategies, dealers have the visibility and flexibility they need to turn market challenges into measurable wins.