NADA UCG: Independents Facing Big Challenges in Used-Car AcquisitionJune 21, 2011 | McLEAN, Va. By Auto Remarketing Staff Jonathan Banks, NADA Used Car Guide

In a market where wholesale auction volume is even tighter than overall used supply, independent dealers face an especially “tough situation” when it comes to acquiring the vehicles they need on their lots, suggested Jonathan Banks, a senior analyst with NADA Used Car Guide.

In his Used Car & Truck Blog, Banks points out that wholesale auction volume in 2011 has fallen 10 percent from 2010, compared to about a 2-percent drop of overall used supply. What’s more, for compact cars, the total used supply has actually increased 5 percent, while the auction volume is actually down 16 percent.

“Since most of the 35,000 independent auto dealers rely heavily on traditional brick-and-mortar auctions for their inventory, they are faced with an environment of very tight supply which exceeds the market as a whole,” Banks pointed out.

“What makes this situation more interesting is that strong demand for used models contributes to lower supply at the auctions,” he added. “This occurs because more used vehicles are being acquired farther upstream of traditional auctions by the franchised new-car dealer.”

Franchised dealers, of course, typically have more expansive avenues for used-vehicle acquisition. They are privy to increased trade-in volume via new and used sales, first dibs (after the lessee) on buying end-of-term lease vehicles and the online marketplaces of their respective OEMs or captives that give them first crack at used units before they trickle downstream into auctions, Banks explained.

“In most cases, this removes a large majority of pristine condition, low-mileage vehicles from the traditional auction channel, which correspondingly changes the mix of vehicles available,” he noted.

“The result is an increase in prices for all used vehicles, particularly those vehicles sold at a physical auction,” he added. “This is even true for models that may have been considered undesirable in the past.”

Going forward, it is likely that the rest of 2011 and 2012 will continue to see drop-offs in used supply, according to NADA.

Banks also noted that data from the Conference Board and CNW Research points to robust demand for used vehicles, as well.

“In addition, gross profit margins for used vehicles are (approximately) 9 percent higher than on new vehicles, according to NADA’s Dealership Financial Report, and most franchise dealerships have made considerable investments to improve the used-vehicle buying experience,” Banks pointed out.

“Because of this, franchise dealer demand will continue to be strong for used models which will perpetuate the tight inventory at brick-and-mortar auctions and will help keep used prices high during the upcoming months,”

Read more. Auto Remarketing | NADA UCG:

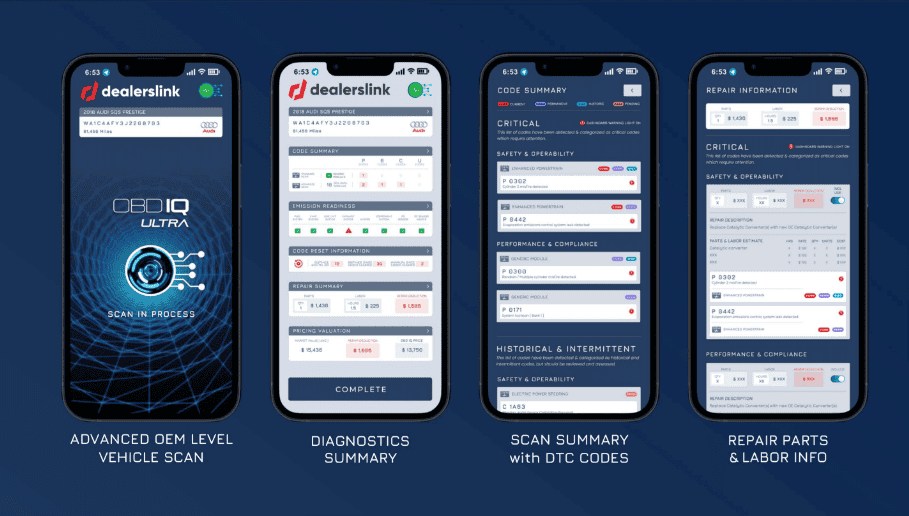

To learn more about Dealerslink®

CONTACT: Travis Wise at 877-859-7080 x302 travis.wise@Dealerslink.com